Everyone makes New Year’s Resolutions that they often don’t keep. But, financial resolutions are something you should stick to. To make it easier, here are some finance new years’ resolutions you can start now.

Start Making Investments

Next year, start on the road to financial freedom by investing in stocks, property, or business opportunities. Keep on the lookout for investment apps like Acorn, Robinhood and try them when they hit your market. Become an investor in a promising product or business. When it matures, you can count your return.

Start a savings account

A savings account is different from a checking account and is designed to provide you with a long-term savings plan. You should have a savings account for general emergencies. And, if you want to increase your financial efficiency, open a second savings account specifically for one-time purchases or events like a car, wedding, house or similar investment.

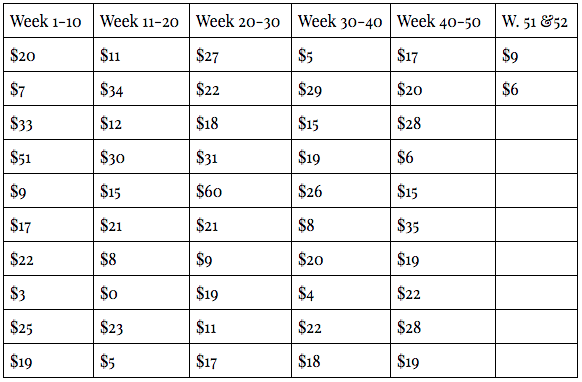

You have to have an actionable plan for maintaining and building it up as well. By saving just a few dollars each week, you can build up a simple savings account of $1000 (3,272 AED) in a year. Start with $20 in the first week of January and use the chart below to get you the rest of the way.

Pay off a debt

One of your financial new year’s resolutions should include paying off a debt. Start with your smallest one and begin making additional or larger monthly payments on it.

You can use your second savings account specifically for the allocation of funds designed to pay off your debts. Once your debt has been paid, monitor your spending habits to ensure you don’t get into financial trouble again.

Fix Your Credit Score

One way to fix your credit score is to pay off your debts. So, use the advice above to begin paying off your credit card, loan and other debts. Once you pay one commitment, don’t stop. Instead, choose your next debt and begin paying extra on this the following month.

Another way to fix your credit score is to acquire new credit and pay it off responsibly. But, if you’re already in debt, borrow responsibly. Start with a small loan or credit card, which is secured or unsecured. Make small purchases with it that you know you can afford in cash. Then, on your next billing cycle, pay off your balance in full.

Credit scores are about more than just accounts. They measure your usage and balances. Remaining balances each month will lower your score.

Lower Your Spending Habits

Just like responsible credit habits, when monitoring your spending, do not spend more than you can afford. Set a monthly budget that totals your income. Then, subtract your debts and bills from it. What remains is your available spending money.

From this total, set a percentage for how much you want to allocate for investments, savings accounts and paying off debts with higher monthly payments each month. Now, what remains can be spent on unnecessary items, responsibly.